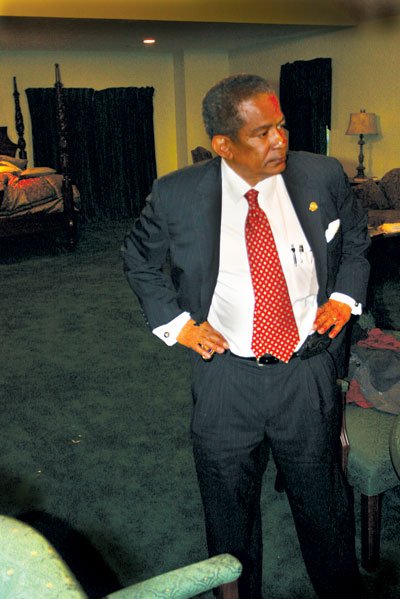

The mayor of the city still has not paid his property taxes, according to the Hinds County Tax Assessor's office. Photo by Patrick Butler

The Hinds County Tax Assessor's office told the Jackson Free Press that Mayor Frank Melton, an individual holding one of the most esteemed offices in the city, has yet to pay property taxes on one of his city addresses.

The mayor is four months behind on his taxes on property at 2 Carter's Grove, in northeast Jackson. Taxes were due at the end of February.

Melton currently owes more than $9,000 for his $352,820 gated home in the affluent neighborhood. He has paid more than $700 toward neighboring property, though the bigger payment so far eludes him.

Melton's procrastination does not stop at the county in which he serves as mayor. Melton and his wife, Ellen, also own property in Smith County, Texas, but the Smith County Tax Assessor's office reports that Melton and his wife have only paid a portion of the $8,864 in taxes and penalties on their $500,000 home as of May 13. Taxes were due on Melton's Texas home at the end of January, placing him five months behind in that county.

Hinds County Tax Collector Eddie Fair said his office mails notifications of delinquent taxes every three months, and said Melton should have received one by now.

"We do not send out employees to knock on your door, but we certainly do make sure you know your situation," Fair told the Jackson Free Press. "People may try to write this off, but this is serious business."

Melton did not return calls to the Jackson Free Press.

Fair admitted that this is not the first time the mayor has put off paying his taxes. Last year Melton delayed writing a check for a month after the due date.

Hinds County Tax Assessor employee Kathy Chestnut said the mayor has until Aug. 22 before the county puts his property up for tax sale, but even if another buyer purchases Melton's debt out from under him, Melton still has three more years of delinquency to squander before actually running the risk of losing his home.

"The way the system is, you don't automatically lose your house," Chestnut said. "You still have three years to redeem it, but what it does is you have court costs included, you have interest and fees included. You have these bankers and these mortgage companies come in and they get, like, a 1.5 percent interest per month after the first month. They make their money off you."

Ward 3 Councilman Kenneth Stokes defended Melton's delay in The Clarion-Ledger, saying businessmen frequently delay their tax payments until the very last month.

"Most don't consider it really being late until the property goes to the land sale," Stokes said earlier this month.

Fair said Stokes' assessment is wrong.

"That's not true," he said. "Business people don't make a habit of doing that. My advice is to pay your taxes and avoid accruing interest and penalties."

Comments

Use the comment form below to begin a discussion about this content.