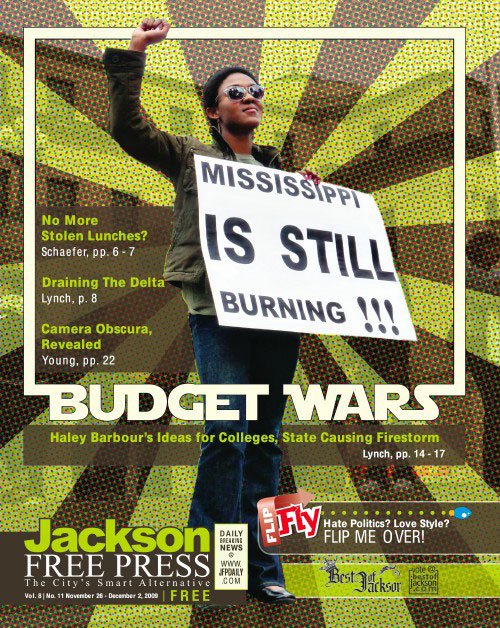

On the cover: Rachel Johns protests the proposed merger of HBCUs at the state capitol. Photo by Lacey McLaughlin

Gov. Haley Barbour is in crisis mode. The state is up against a $715 million budget shortfall in fiscal year 2011, by his estimates, and another $500 million shortage in fiscal year 2012. The deficits combine to create a $1.2 billion deficit by 2012, compared to the relatively blissful fiscal year of 2010. Mississippi doesn't often get to brag about any figure with the letter "b" in front of it, but abetting the already rotten situation in 2012 will be the loss of $370 million in federal stimulus money that is available only through fiscal year 2011.

"We will have significantly less revenue than in years past creating a structural deficit that leaves us no choice but to further reduce government spending," Barbour wrote in his Nov. 16 budget proposal.

The governor is against covering any shortfall with new revenue generation, in his proposal calling taxes "the enemy of controlling spending."

"Forcing our citizens to cough up more of their hard-earned money by raising taxes is not the right approach, particularly in these difficult economic times," Barbour wrote.

That anti-tax disposition closes many avenues for sealing shortfalls outside of cutting government services. Barbour proposed an across-the-board 12 percent cut to many agencies, although he plans no serious cuts to the Mississippi Development Authority, which is under his direct control through board appointments. The MDA will see only about a 5-percent cut in his proposal because he said the agency is needed to jump-start new businesses in the state and keep current businesses from relocating or closing down.

Barbour reveals an equally protective stance toward the justice system."

That role apparently extends to the state's growing industry of criminal incarceration.

Derrick Johnson, president of the Mississippi NAACP, criticized the governor for demanding no deep cuts for the prison system, while requesting the merger of the state's three historically black public universities.

Critics abound over the governor's call to merge Mississippi Valley State and Alcorn State with Jackson State. No campus would close, Barbour said, but administration would be unified and save the state $35 millionnear the $33 million cost of Barbour's call to invest in a new tax-collecting computer system in 2010. The governor said the Alcorn and MVSU campuses would still continue to function, although there would be a rationing of class offerings at the campuses. Students could definitely look forward to cuts in curricula at those campuses if legislators go along with him.

"This shows us where the governor's priorities really are when it comes to education for black people," Johnson said, pointing to the governor's penchant for cutting school and education budgets. "He wants to reduce education, but keep the prisons running."

Public Schools Back Under Knife

School suffering does not end at the college level.

"It's high time to recognize that Mississippi's having 152 school districts across 82 counties is a model of inefficiency," Barbour said. "Consolidating school districts will reduce administration costs in the short term, will ultimately match effective teachers with 'right sized' classes, and will push more money into the classroom, improving educational achievement by our K-12 students."

The governor's recommendation assumes that district consolidation will retain the same number of teachers while cutting out administrative costs for positions like superintendents and their staff. But the consolidation of something as legally touchy as the school system of a formerly segregated state, according to Rep. Cecil Brown, D-Jackson, is not as easy as swinging a very big knife.

"There are some legal issues that will have to be crossed," Brown told the Jackson Free Press.

The problem, Brown said, is that you can't pick out 50 districts to merge that wouldn't include some majority-white districts fusing with some majority-black districts, which will inevitably call into play voting rights issues.

"We will never get that kind of thing cleared by the Justice Department," Brown said. "Let's just say you want to merge Canton into Madison County. You've got a substantially majority-black district moving into a much, much larger majority-white district, and all of a sudden you've diluted the black voting strength. Is that going to pass muster? In a large number of those (consolidated districts), that's going to be an issue."

School districts use different methods to install school board members. Some are appointed, while others are elected. But even the districts with appointed boards and superintendents will give legislators bloody hell when they try to replace a superintendent, perhaps appointed by a local white mayor, with a black superintendent from a larger nearby county. Imagine merging the Ridgeland school system with its bigger southern neighbor, Jackson, and you can get an idea of the potential complications.

"I don't know if consolidation is hopeless, but it's certainly not going to save any money in the short term because it's not going to get approved in the short term. There are innumerable problems with his proposition," Brown said.

Canton Superintendent Dwight Luckett was already gearing up for a fight, according to a letter he sent to the media this week. "Consolidating the Canton Public School District with the Madison County School District is not the answer to overcoming the years of challenges that have plagued the educational system in this area," Luckett wrote. "The answer is making sure you have quality leadership and quality teachers in place to meet the challenges of more rigorous accountability measures that are in place to make sure children are receiving a quality education."

Professional staff in both districts are essential to keeping the students productive and competitive, Luckett argued. He then called out a laundry list of recent improvements to the Canton district, including a lowering of the dropout rate, a subsequent increase in the graduation rate, and the removal of three schools out of the "at risk" category.

The aggravation for K-12 schools doesn't stop at consolidation. Barbour's budget plan also includes slicing away at the Mississippi Adequate Education Program, the funding formula for K-12 that steers state money toward school districts with significantly less sales tax revenue than other districts in order to provide an "adequate" level of education.

"I am recommending a 10.9 percent cut for the Mississippi Adequate Education Program. Total K-12 education would see a cut of 9.4 percent," Barbour wrote, explaining that the reductions "provide an impetus for true reform" in the state's educational structure. The governor said in his proposal that the cut in the number of districts would actually lessen the blow of the severely reduced MAEP.

Public School lobbying group The Parents' Campaign explained that the 10.9 percent cut in FY2011 means a reduction of about $237 million less than the FY2010 budget of $2.2 billion. The real numbers actually add up to even more of a loss when considering the annual growth in need.

Parents' Campaign Director Nancy Loome said the true reduction amounts to about $300 million in cuts, after considering that the state Legislature will likely be neglecting the Mississippi Department of Education's request for a $61 million increase in MAEP funding for fiscal year 2011.

"This is no time to back off of our commitment to providing a high quality education for every Mississippi child. Maintaining that commitment will be critical to the future of our children and our state," Loome said in a statement.

She also urged legislators to remember that the recommendation is nothing more than a recommendation at this point. "The Mississippi Legislature has constitutional authority over the state budget, and it is the Legislature that will make the final budget appropriations," she wrote.

Health Care to Take Hit

The governor also proposes big cuts for Mississippi Department of Human Services.

"Unless legislative changes are made to the program, Medicaid will need more than $200 million more state dollars in fiscal year 2011 than was appropriated in fiscal year 2010," Barbour wrote, adding that the agency will require an additional $220 million in state funding in 2012, amounting to an appropriation of $875 million.

"The state of Mississippi can't afford a Medicaid program that costs state taxpayers $875 million a year," the governor said.

Barbour suggests a host of cutbacks to keep the program stable, including reducing state expenditures for non-long-term hospital care and payments to some health-care providers and pulling state coverage for transportation costs for dialysis patients.

Mississippi Coalition for Citizens with Disabilities Executive Director Mary Troupe told the Jackson Free Press that if the state pulls coverage for transportation, patients would be left on their own to find transportation, which can be problematic for largely immobile retirees whose children and relatives have moved out of state.

"The state would have to arrange for some agency to take up the work that they abandon," Troupe said, explaining that Barbour's recommendation makes no mention of an alternative method and how to pay for it.

Troupe expressed similar concerns over Barbour's plan to close four of the state's Department of Mental Health facilities and six crisis centers, including the Brookhaven and Cleveland crisis centers and the North and South Mississippi state hospitals.

She is no fan of institutionalized health care. She has worked with House Public Health Committee Chairman Rep. Steve Holland, D-Plantersville, to pass a law to allow the Department of Medicaid to steer money normally reserved for institutional care to home-based nursing.

Barbour, who had been silent on the matter for more than five years, seems to have finally adopted an opinion on the issue, but his sudden embrace of the concept appears half-cocked, Troupe said. Barbour includes no details in his recommendation to expand the field of home-care nursing.

"I agree that these institutions should not be relied upon to the exclusion of home and community-based care. Home-care nursing, when feasible, is less expensive and less painful for the patient, but you can't just close down these institutions and dump the patients into the street," Troupe said. "You'll fill the prisons with the mentally ill."

The Opportunist

Barbour draws some of his old personal crusades directly into the budgetary challenge. Page 13 of his proposal re-ignites his years' long battle with the Mississippi Hospital Association by demanding that hospitals hand patients a new tax for being sick. "Medicaid will need more than $200 million (in fiscal year 2011)," Barbour wrote. "Raising the hospital assessment to $75 million at this time will generate part of the needed revenue for the state and put the tax on par with the state match requirement."

Members of the Legislature who typically side with the powerful hospital lobby have repeatedly beat down the governor's attempts to charge hospitals this same tax for treating Medicaid patients.

The fee would not be evenly distributed if it resembles a $90 million fee Barbour tried to create this year. In fact, some hospitals, like Gulfport Memorial, would see about $6 million in additional taxes as a result of the fee, while Hancock General would see about $330,000 in additional taxes, based upon the number of Medicaid patients they accommodate. The hospital lobbywhich worked with Barbour to pass tort reform limiting plaintiffs' malpractice awardsadopted the argument that these fees would have to be financed through a cut in hospital staff or a direct tax on patients who were not Medicaid recipients.

The argument has not changed over the months, with legislators warning that the return of the assessment would again spell tax increases on the local level, even as Barbour preaches against tax hikes.

It's not the only local level tax hike sure to see the light of day under the governors' "taxes is the enemy" budget proposal. Barbour rides a "no new taxes" argument, but his proposal for 2011 and 2012 makes tax increase nearly inevitableat least on the local level.

The governor called upon local school districts to tap into their rainy day funds to cover holes in their budgets, even as the state taps its own $300 million rainy day fund by about $78 million in fiscal year 2011 and another $80 million in 2012 and 2013.

"Now is the time to reduce administrative costs and for local districts to use their "rainy day funds" just as the state is drawing down on its rainy day fund," the governor proclaimed in his Nov. 16 proposal.

But the rainy-day fund of local schools is not the same kind of animal as the one on the state level, and not nearly as stable.

Michael Thomas, deputy superintendent for operations at Jackson Public Schools, said JPS' fund is not quite up to par with younger, suburban districts with newer infrastructure.

"We've got about $13 million sitting in our rainy day fund," Thomas said. "Our goal was to have about 10 percent of our operating budget. Our operating is $235 million, so we're actually at about 6 or 7 percent of our budget. We're not where we need to be, but we're holding our own. Districts like Desoto County have about $30 million in their account because they're not incurring the kinds of (infrastructure) expenses that we're incurring."

Some other counties are also better off because local sales taxes, driven by residents with more expendable income, are flying off the chart compared to inner cities. Jackson Public Schools, for example, has a student population that is significantly poorer than that of the suburbs. Almost 90 percent of the population qualifies for a free or reduced lunch in Jackson, whereas only about half of the student population in suburban spots like Desoto and Rankin County qualify for government-financed lunches.

The Transferred Tax Increase

While some of the more prosperous districts are in a better condition to weather the storm, other districts will be eyeing the possibility of tax increases as they learn their funds are inadequate for keeping teachers teaching and the school air-conditioner working at the same time.

Jackson Parents for Public Schools Executive Director Susan Womack warned that some school systems won't even have the luxury of tax increases to fall back on.

"So what if you increased it? What would that give you in some of these districts, $20,000 or $30,000? Some of these districts just don't have the size or population to handle any useful money from a tax increase," Womack told the Jackson Free Press.

Rep. Kelvin Buck, D-Holly Springs, said that the state may soon erase the subsidy relating to car tagsa $27 million decision that will be passed on to the local level.

"It'll be like passing a tax on the local level while wiping your hands of it at the state level," Buck said. "There's a subsidy that the state has been doing. You'll see it on your tag receipt when you pay for your tag. If it were not for the subsidy, then your tag would be considerably more expensive each time you went to buy it. Barbour's budget proposal says to do away with that entirely."

Legislators established the subsidy program in the mid-1990s. Since then, it's grown on us.

Politicians felt passionate enough over the issue to make headlines with the fighting during the 2009 legislative session. The Senate and the House had actually approved a bill to boost the state's excise tax on tobacco from 18 cents to 68 cents per pack. The 18-cent tax had remained unchanged since 1985 and had been one of the lowest in the U.S.

Barbour, a former tobacco lobbyist in Washington, had fought against a tax increase on tobacco since he arrived in office, but finally caved to the popular tax this year. Still, House and Senate leaders battled over where to put the new revenue. Medicaid advocates called for the money to shore up Medicaid, arguing that smokers demanded more money out of the state health system, while opponents sought to maneuver the money to the general fund.

Eventually, legislators agreed to steer a portion of the tax increase to fill a portion of a growing hole in the car-tag subsidy program. A portion of what's collected from the cigarette tax is slated for the car tag fund this year, providing almost $30 million by the next fiscal year.

Still, if legislators follow through with Barbour's recommendation, car tags will jump in price, regardless of the new influx of money.

"I don't think people want to see their car tags jump up in price, certainly not now," Buck said. "But that's the problem with this recommendation. A lot of it will contain tax increases, even if the governor says he's against them. They're just not on the state level."

Comments

Use the comment form below to begin a discussion about this content.

comments powered by Disqus