JACKSON, Miss. (AP) — A computer conversion at the Mississippi Department of Revenue delayed some revenue collections from being posted and contributed to a report that showed a September drop in state tax collections.

"During the 'time-out' for conversion to our new system, tax returns were not posted to taxpayer accounts," Waterbury explained. "Revenue is not recognized until the return posts, even though the money was in the treasury. All of the returns posted within the first few days of October and that revenue will be reflected in October collections," agency spokeswoman Kathy Waterbury told the Northeast Mississippi Daily Journal (http://bit.ly/SXXGCk ).

In other words, unless there is a real major drop in tax collections, October should be reflected as a strong month.

A summary of revenue collections for the month of September by the staff of the Legislative Budget Committee revealed collections were $37 million less than for the same month in 2011.

The same summary revealed than between July 1 and Sept. 30, the state collected $22 million, or 2.2 percent, less than during the same time period in 2011.

Despite the slow September caused by the conversion, collections still were above the estimate by $9.2 million, or 2.4 percent, not counting $35.2 million deposited in the treasury by Attorney General Jim Hood as a result of settlements of lawsuits with pharmaceutical companies over allegations of overcharging the state for drugs for Medicaid recipients.

The estimate developed by the legislative leadership upon advice from the state's financial experts is important because it represents the amount of money appropriated by the Legislature.

When the legislative leaders developed the estimate this past April, the slowdown in September collections caused by the conversion and the uptick in October were factored into the equation.

For the first quarter, collections are $22.6 million, or 2.3 percent, above the estimate not counting the deposit by the attorney general.

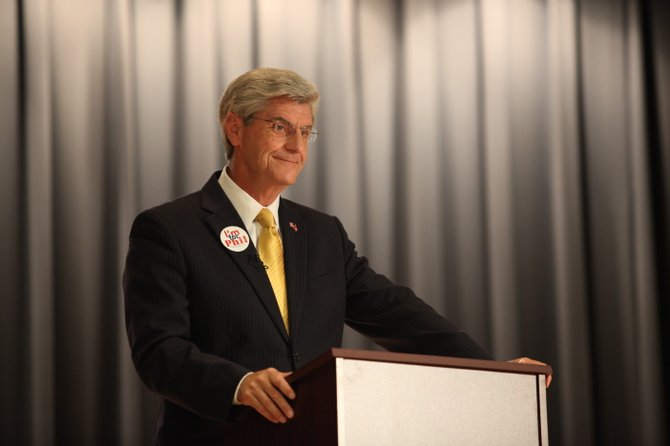

Gov. Phil Bryant will meet with legislative leaders and the lieutenant governor to adopt a revenue estimate on Nov. 12 to be used by the Legislature in developing a budget during the 2013 session. While the estimate is adopted in the fall in advance of the start of the session, the legislative leadership normally changes the estimate near the end of the session just before passing a final budget.

Copyright Associated Press. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.

Comments

Use the comment form below to begin a discussion about this content.

comments powered by Disqus