As job losses mount, some economists say the nation's unemployment rate could approach 13% by May. By comparison, the highest jobless rate during the Great Recession, which ended in 2009, was 10%. Photo courtesy Department of Labor

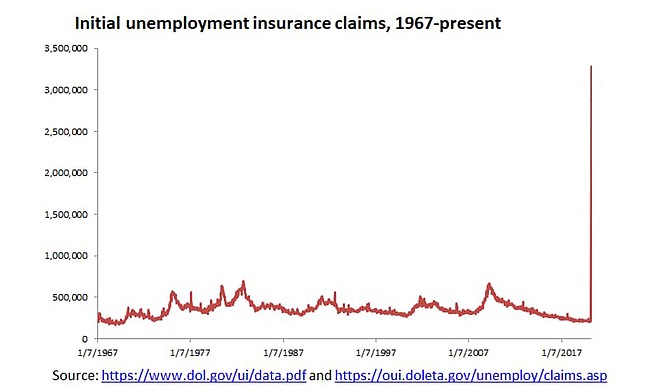

WASHINGTON (AP) — Nearly 3.3 million Americans applied for unemployment benefits last week — almost five times the previous record set in 1982 — amid a widespread economic shutdown caused by the coronavirus.

The surge in weekly applications was a stunning reflection of the damage the viral outbreak is inflicting on the economy. Filings for unemployment aid generally reflect the pace of layoffs.

Layoffs are sure to accelerate as the U.S. economy sinks into a recession. Revenue has collapsed at restaurants, hotels, movie theaters, gyms and airlines. Auto sales are plummeting, and car makers have closed factories. Most such employers face loan payments and other fixed costs, so they're cutting jobs to save money.

As job losses mount, some economists say the nation's unemployment rate could approach 13% by May. By comparison, the highest jobless rate during the Great Recession, which ended in 2009, was 10%.

“What seemed impossible just two weeks ago is now reality,” said Nancy Vanden Houten, an economist at Oxford Economics, a consulting firm. “The US economy will experience the largest economic contraction on record with the most severe surge in unemployment ever.”

The economic deterioration has been swift. As recently as February, the unemployment rate was at a 50-year low of 3.5%. And the economy was growing steadily if modestly. Yet by the April-June quarter of the year, some economists think the economy will shrink at its steepest annual pace ever — a contraction that could reach 30%.

In its report Thursday, the Labor Department said 3.283 million people applied for unemployment benefits last week, up from 282,000 during the previous week. Many people who have lost jobs in recent weeks, though, have been unable to file for unemployment aid because state websites and phone systems have been overwhelmed by a crush of applicants and have frozen up.

That logjam suggests that Thursday's report actually understates the magnitude of job cuts last week. So does the fact that workers who are not on company payrolls — gig workers, free-lancers, the self-employed — aren't currently eligible for unemployment benefits even though in many cases they're no longer able to earn money.

With layoffs surging, a significant expansion of unemployment benefits was included in an economic relief bill nearing final approval in Congress. One provision in the bill would provide an extra $600 a week on top of the unemployment aid that states provide. Another provision would supply 13 additional weeks of benefits beyond the six months of jobless aid that most states offer. The new legislation would also extend unemployment benefits, for the first time, to gig workers and others who are not on company payrolls.

Separate legislation passed last week provides up to $1 billion to states to enhance their ability to process claims. But that money will take time to be disbursed.

Worldwide, the United Nations estimates that up to 25 million jobs could be lost in the economic upheaval from the viral outbreak. That would exceed the 22 million that were lost during the 2008 global financial crisis.

In Europe, companies are laying off workers at the fastest pace since 2009, according to surveys of business managers. Official statistics for Europe that would reflect the outbreak's impact are not yet out. But companies have been announcing tens of thousands of job cuts, both permanent and temporary. Major car companies like Fiat Chrysler and airlines like Lufthansa are suspending most of their operations, putting tens of thousands of workers on temporary leave, many with only a partial salary.

The unemployment rate in the 19 countries that use the euro was 7.3% at last count in January. It's expected to rise toward 10%, depending on the duration of the outbreak, economists say. The rise in joblessness may not be as sharp as in the U.S. because it's harder to fire workers in Europe, where many governments are supporting companies financially to keep employees on partially paid leave.

In the United States, the jump in applications for benefits is playing out in states across the country. In California, claims for unemployment benefits more than tripled last week to 187,000. In New York, they rose by a factor of five to 80,334. Nationwide, about 2.25% of the entire workforce applied for jobless aid last week. In Nevada, the figure was 6.8%, in Rhode Island 7.5%.

Gov. Gavin Newsom said 1 million claims for unemployment benefits had been filed in California since March 13. Many of those applications were likely filed this week, suggesting that next week's report could show an even bigger number of claims.

In Florida, Jessy Morancy of Hollywood was laid off last week from her job as a wheelchair attendant and customer service agent at Fort Lauderdale Airport. Morancy, 29, called the state unemployment office on Monday to try to file for unemployment benefits but encountered just a recorded message telling her to call back later.

She was also concerned that even a full unemployment benefit of $275 a week would be less than half of what she earned at her job and insufficient to provide for her children, ages 10 and 7.

“I’m still in a state of shock,” Morancy said.

She said she has heard that airline employees might continue to receive salaries if Congress provides financial assistance to the airlines. Yet even so, it’s not clear that employees like her who work for contractors — Eulen America, in her case — would be eligible.

“If these companies are going to get a bailout, why not include us?” Morancy said.

Even for those able to file a claim, the benefits will take time to kick in. It typically takes two to three weeks before applicants receive any money. State agencies must first contact their former employers to verify their work and earnings history. Only then can the employee’s weekly unemployment benefits be calculated.

Worsening the problem, most state agencies that handle unemployment claims are operating at historically low funding levels and staffing that are intended to handle a trickle of claims. Just weeks ago, the job market was in the strongest shape it had been in decades.

Kim Boldrini-Sen, 41, has also struggled to file her claim. She has tried in two states: In Connecticut, where she works as an acupuncturist in a private practice, and in New York, where she lives and has her own acupuncture business.

In Connecticut, she thought her application had been submitted. But when she returned last week to re-file as applicants are required to do each week, she found there was no record of her initial filing. After taking an hour to re-file, she received a pop-up notice that she was ineligible to do so online.

In New York, the state's website repeatedly crashed when she was halfway through filling out her request. When she finally managed to press submit, she received a pop-up saying she had to file over the phone. That hasn't worked well, either.

“I've called at all hours of the day,” she said. "That's been my life for a week, and I still can't get through to anyone."

On Wednesday, the New York State Department of Labor tweeted, "If you have been unable to get through our phone and/or online system this week, please keep trying."

"We are working as hard as we can to ensure that all benefits are paid and appreciate your patience," the agency said on Twitter.

Ellen Zentner, an economist at Morgan Stanley, said in a note to clients that 17 million jobs could be lost through May -- twice the entire 8.7 million jobs that were lost in the Great Recession. She expects the unemployment rate to average 12.8% in the April-June quarter, which would be the highest level since the 1930s.

Still, Zentner also expects the economy to start recovering by the second half of the year. But it will take time for things to return to something close to normal, she projects: The unemployment rate could still top 5% at the end of next year.

Copyright Associated Press. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.

Comments

Use the comment form below to begin a discussion about this content.

comments powered by Disqus